Todays Breaking News Headlines

Latest in Todays News : World News

1.7k Views1000 Votes

Mystery Surrounding Kate Middleton's Absence Sends Internet Into Frenzy

20 Shares1.7k Views1000 Votes

Israel-Hamas Crisis: Troop Preparations and Middle East Tensions

10 Shares2k Views1000 Votes

Hurricane Idalia Aftermath: Devastation and Recovery Efforts Unfold Across Southeast

Global Business News

1.3k Views969 Votes

Michael Gove's VIP Football Ticket Fiasco: A Breach of Standards Unveiled

10 Shares1.4k Views969 Votes

Trump Bond Debacle: Insurance Giants Shun $464 Million Surety Bid

1.2k Views969 Votes

Unveiling the Epic Journey: World of Warcraft Expansion Resilience!

Latest in Global Politics

10 Shares1.7k Views1000 Votes

in Africa, Articles, General, Global Politics, Health, Insurance, Joe Biden, Technology, Todays Headlines, WOWPandemic Agreement Negotiations: Navigating the Path to Global Health Equity

Breaking News USA

40 Shares2k Views956 Votes

Breaking: Russell Brand Faces Shocking Allegations of Sexual Assault and Abuse

Breaking News Canada

10 Shares1.5k Views956 Votes

California FAIR Plan: Navigating the Insurance Crisis

Breaking News Africa

10 Shares1.7k Views1000 Votes

Pandemic Agreement Negotiations: Navigating the Path to Global Health Equity

Entertainment News

40 Shares2k Views956 Votes

Breaking: Russell Brand Faces Shocking Allegations of Sexual Assault and Abuse

50 Shares2k Views969 Votes

Unlocking the NFT Craze: Netflix Secures ‘NFT:WTF?' Documentary for UK Viewers

Unraveling the Enigma: Netflix Acquires ‘NFT:WTF?' Documentary for UK Audience

1.2k Views969 Votes

Unveiling the Epic Journey: World of Warcraft Expansion Resilience!

Discover the Momentum: Unveiling World of Warcraft's Expansion Success Story!

10 Shares1.6k Views1000 Votes

Stray Kids Achievements: Breaking Records and Rising Stars in the K-pop Universe

1.7k Views1000 Votes

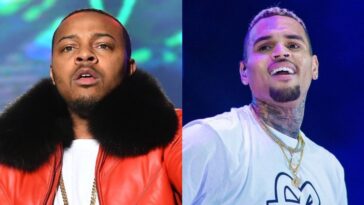

Bow Wow and Chris Brown Drop Surprise Collaboration: Music Comeback Unveiled!

Bow Wow and Chris Brown Unite for Epic Musical Comeback Surprise!

210 Shares3k Views1000 Votes

Unmasking Financial Deception: Italy Takes Aim at Tax Evasion Investigations

Tax Evasion Scandals and Forced Labor Allegations Shake Business World

Fun and Travel

20 Shares1.6k Views1000 Votes

in Articles, Business, Business Loans, Energy, Recipes, Todays Headlines, Travel & Fun NewsDive into Delight: Unveiling the Spectacular Holi Weekend Getaways Near Delhi 2024

Quizzes

Polls

20 Shares1.6k Views1000 Votes

in Articles, Donald Trump, Insurance, Joe Biden, Media, Polls, Todays HeadlinesJoe Biden's Comeback Quest: Reality or Rhetoric?

Todays Sport and Fitness News

Health Education and Science

Health News

Education News

Science News

Energy News

Insurance News

Viral News and Personalities

Viral News

1.4k Views1000 Votes

Discover the Irresistible Crookie Food Trend Sweeping the Nation!

Donald Trump News

1.4k Views969 Votes

Trump Bond Debacle: Insurance Giants Shun $464 Million Surety Bid

Joe BIden News

1.5k Views1000 Votes

Unlocking Success: Your Essential Small Business Insurance Guide

Technology, Food and Religion

Technology News

Latest Recipes

Religion & LGBTQ

Other News

WTF News

NewsBurrow© 2024 by TellGrade Designs. All Rights Reserved.